(This article is written by Shreya Gupta, a fourth-year BBA-LLB Student from Gitarattan International Business School, Rohini, Delhi.)

Introduction

“I like to pay taxes. With them, I buy civilization”, a well said phrase by Jurist Oliver Wendell Holmes Jr… A tax may be defined as a mandatory charge or levy imposed on the taxpayer by a government organisation in order to collect revenue for various public expenditures. The government of India levies taxes on the income of workers and business gains to the cost of some transactions, goods and services. The authority to levy taxes on the taxpayers is enshrined under article 265- article 289 of the constitution. Tax is therefore a mandatory contribution by the people and not a voluntary payment like donations, that adds to the revenue of the government and in return provides facilities to the citizens. Tax is categorised into two parts i.e., direct tax and indirect tax, which will be elaborated on later in this article.

Historical Aspect

In India, the tax was introduced for the first time in 1860 by Sir James Wilson and on 7th April 1860, India’s first Union budget came into the picture and the Indian Income Tax Act 1860 was enforced to meet the losses that occurred on account of the military mutiny of 1857. Later in 1886, Separate Income Tax Act was passed under which the income was divided into four schedules separately i.e. salaries, pensions or gratuities, interest on securities provided by the government of India, net profits of companies and other sources. After this, In 1918 the new Income Tax Act was passed which repealed the earlier act of 1886 and simultaneously Income Tax Act 1918 was also repealed by the new act of 1922. Now the Income Tax Act 1922 for the first time gave a specific nomenclature to various authorities. This act was not repealed and was in force till 1961. Due to uncountable amendments in the Income Tax Act of 1922, the government of India in 1956, referred it to Law Commission in order to simplify it. Finally, in 1961, Income Tax Act 1961 was passed and enforced on 1 April 1962 which applied to the whole of India including Jammu and Kashmir. Since 1962, several amendments have been made to this act. At present, there are five heads of income. They are-

- Income from salary

- House property income

- Income from profits of businesses

- Income from Capital gains

- Other sources income

Need of Taxation

Running an entire country with such a vast population like India is not easy. For this, we are required to pay taxes to the government so that it can perform civil operations along with a good tax structure. A fair tax system leads to equal distribution of wealth in the community. It yields the required revenue for the government. Taxes directly impact the economy of the government and refusing to pay taxes means refusing to contribute to the economy of your country. The objective of stabilization can be implemented through tax policy, government expenditure policy and monetary policy. It is important to meet the demands of society and how is it going to be fulfilled? It can be fulfilled by the proper use of money by the government which we, the people of India, pay through taxes. Certain projects such as health, education, governance and other sectors like transport, infrastructure development etc are being financed by the government and the taxes we pay to contribute to these sectors.

Taxation System in India

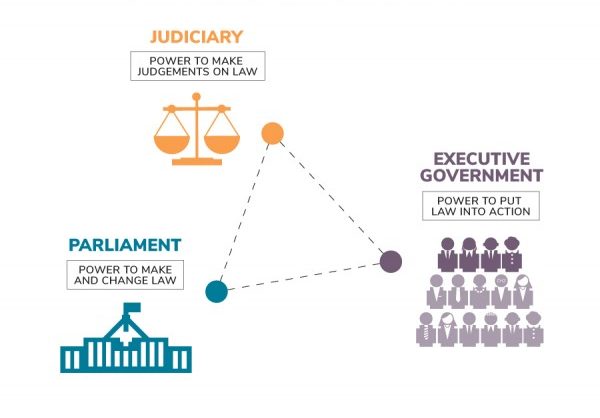

It is a three-tier federal structure that includes-

- Union List (matters on which central government has the power to make laws under Article 246(1) are listed in Entries 82-92B).

- State List (matters on which state government has the power to make laws under Article 246(3) are listed in Entries 45-63).

- Concurrent List consists of the matters on which both the central and state government has power to make laws under Article 246(2) yet it doesn’t deal with taxation therefore both centre and state have no concurrent powers of taxation.

- Entry 97 of List 1 contains residuary powers of taxation belonging only to the centre.

Types of Tax

There are mainly two kinds of taxes, direct tax and indirect tax. The taxes which are paid directly are known as a direct tax. The government levy such taxes on an individual and is untransferable to any other person. Direct taxes are governed under the Central Board of Direct Taxes (CBDT). Some of the acts that are placed under direct tax are Income Tax, Wealth Tax, Gift Tax, Expenditure Tax, Interest Tax.

Income Tax Act governs the income tax of India and lays down the rules and regulations to ensure the proper collection. The income can be generated from any source such as profits from salaries, ownership of a property or some sort of business etc. it also decides the savings from one’s income via investments and tax slab for your income tax. The Act contains total of 23 chapters and 298 sections. These sections deal with various aspects of taxation in India. The central government presents a financial year, every year which brings with it, various amendments to the Income Tax act. The most recent amendment was the inclusion of the introduction of a new optional system of taxation with reduced income tax rates. Taxpayers in India include citizens whose annual income is above 2.5lakh. Other than this, entities such as Hindu Undivided Family, firms, companies, bodies of individuals, local authorities etc are also liable to pay the income tax.

Similarly, the wealth tax Act is linked with an individual’s net wealth and also for Hindu Undivided Family or a company. The gift tax act assures that if a person receives a gift, valuable or monetary, he is liable to pay a tax on such gifts. While the Expenditure act copes with the expenditure made by a person while availing of any services.

Indirect taxes are the taxes levied on goods and services. These types of taxes are not imposed on an individual instead they are, as an alternative, imposed on the products and intermediary. Sales tax, taxes levied on imported goods, value-added tax etc are some of the examples of indirect taxes where Goods and Service Tax is the biggest reform in the structure of indirect taxes.

Goods and Service Tax is a consumption-based tax. It is imposed on value-added services and goods at every stage of consumption in the supply chain. The business adds GST to the price of goods or the product and the customer is required to pay the amount inclusive of the GST. The collected GST is forwarded to the government by the business. India adopted a dual GST structure in 2017. Dual GST is levied simultaneously by the centre and the state government. The main objective was to eliminate double taxation that incurs from the manufacturing level to the consumption level. Dual GST is preferred in countries where the federal structure is followed as the states are independent in their revenue and separated from the centre. This reduces the conflict between centre and state over the distribution of the revenue.

Conclusion

According to me, every citizen of a country must contribute to the economy in any way possible. No, this is not only for the benefit of the government but also for the benefit of the country and the country’s people. It is a wrong approach that we follow that taxation is none other than extracting money from people for the government’s own benefit. If the government is benefited, countrymen are equally benefited. The tax collected is used for the expenditure on the projects that are contributing to enhancing the economy. One should consider it as a duty towards the economy and not a fine imposed by the government. If the people are availing all the benefits provided by the government, they should have a sense of responsibility to fulfil towards the country.

References

https://www.incometaxindia.gov.in/pages/tax-laws-rules.aspx

https://www.google.com/amp/s/blog.ipleaders.in/law-taxation-constitution-india/amp/

https://www.policybazaar.com/tax/https://www.policybazaar.com/tax/

https://taxguru.in/income-tax/history-evolution-income-tax-act-india.html?amp